News

Back to event : Batteries, a sector in full transformation

The sixth meeting of the "Batteries" working group, organized by Tenerrdis on September 23, 2025 in Grenoble, provided an opportunity to take stock of the sector's major transformations. European regulations, eco-design and insurance were at the heart of the discussions, testifying to the strategic challenges facing the industry.

The meeting was co-hosted by our members Upergy, Addev materials, In Extenso & Howden group.

A European regulation that reshapes the market

Context

Since August 18, 2025, Regulation (EU) 2023/1542 has become the single reference for batteries. It replaces Directive 2006/66/EC, which has been definitively repealed, and introduces stringent requirements in terms of eco-design, data transparency, component traceability, collection and recycling.

The aim of this legislative transition is to ensure better recovery of critical resources, limit dependence on raw material imports and reinforce circularity.

Source: Ademe

New categorization of batteries with an overhaul of eco-organizations

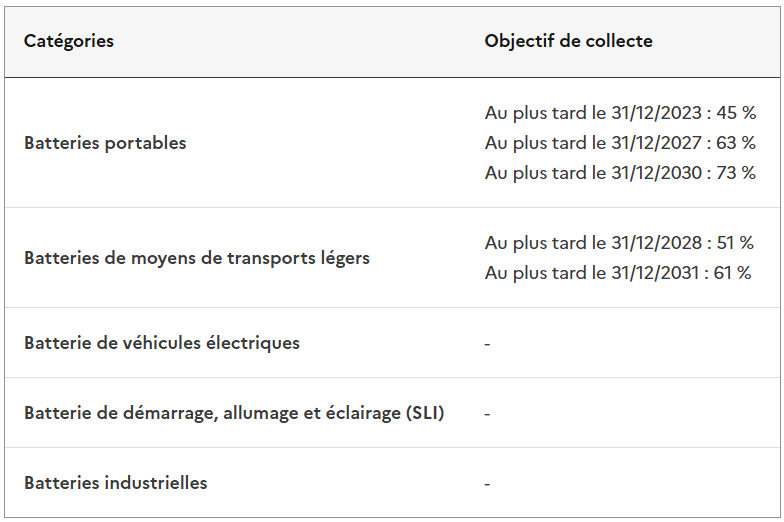

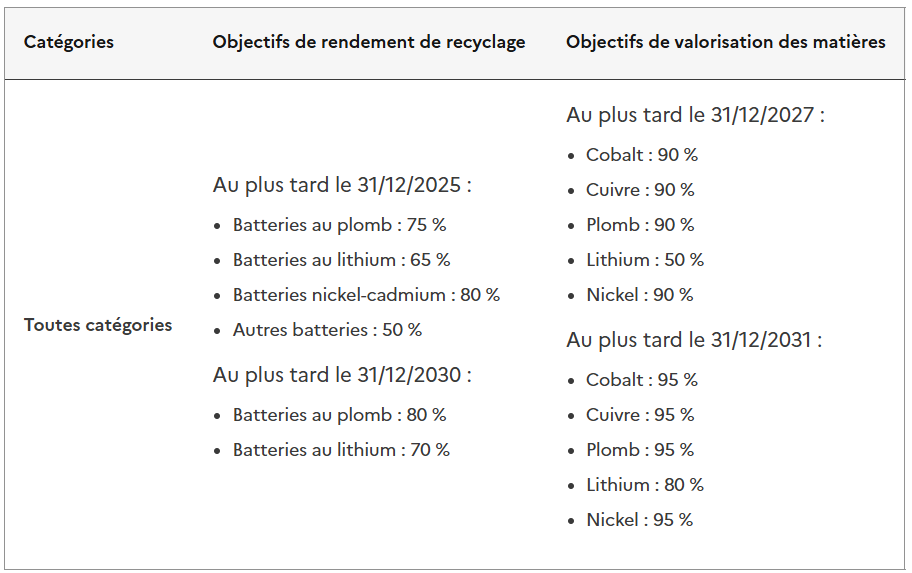

The reform redefines battery categories from three to five:

- Portable batteries (rechargeable/non-rechargeable < 5kg)

- Medium-weight batteries (MTL, 0-25kg)

- Industrial batteries (INDUS)

- Electric Vehicle Batteries (EV, > 25kg)

- Starting / Lighting / Ignition batteries (SLI)

The new regulations require all producers - manufacturers, importers, distributors, foreign sellers, second-life operators - to submit an application for an EPR authorization.EPR (Extended Producer Responsibility) authorization to the public authorities, and to join an approved eco-organization. Three organizations were approved on August 18, 2025 and will remain so until 2030:

- Ecosystem, which absorbs Corépile and now covers the 5 battery categories as well as electrical and electronic equipment (EEE)

- Batribox (formerly Screlec), which will handle all 5 battery categories

- Recycler mon véhicule (Recycle my vehicle), which will only cover the Electric Vehicle (EV) category.

An eco-tax for batteries must be paid to one of these eco-organizations. This is a fee paid by producers to finance the collection, treatment and recycling of battery waste. It is calculated in €/kg or €/unit. For companies, the financial impact of this eco-tax is far from insignificant: it can represent between 1 and 1.5% of sales, up to several hundred thousand euros a year.

A veritable price war is currently raging between the various eco-bodies. Faced with this situation, some companies could opt for a pragmatic strategy: join both organizations and select the most advantageous rates on a case-by-case basis, depending on the types of batteries placed on the market. This competition can be explained in part by the private status of the eco-organizations, which are now vying for a field of competence extended by the new regulations.

Second life, battery passport and safety

The second life of batteries is also addressed in the text, with the aim of providing a framework for the reuse, reallocation and remanufacturing of batteries at the end of their life. The regulation provides for the progressive incorporation of recycled metals in the manufacture of new batteries (2% of tons collected by 2027 and 5% by 2030). Batteries will be considered both as waste and as resources. According to RDC Environnement (2023), by 2040, the deposit of second-life batteries from mobility could reach 45 kt in France and 300-350 kt in Europe.

From August 18, 2025, all batteries placed on the market must carry the CE mark, a guarantee of compliance with European safety, health and environmental standards. This obligation will be reinforced on February 18, 2027, when batteries for electric vehicles, light transport and industrial batteries with a capacity greater than 2 kWh will be required to carry a digital passport.

This passport will take the form of a unique QR code linked to an electronic database. It will have to contain precise information on the manufacturer and battery model, including its chemistry, capacity and production site. It will also indicate the carbon footprint expressed in kilograms of CO₂ equivalent per kilowatt-hour of energy supplied, detailed by life-cycle phase, as well as the battery's estimated lifespan. The document must include the European Declaration of Conformity identification number, a link to the fullenvironmental study, as well as any hazardous substances present and associated safety risks.

When it comes to hazardous substances, European regulations now set particularly strict thresholds for limiting the presence of heavy metals in batteries. Mercury content must not exceed 0.0005% by mass, cadmium 0.002%, while lead has been limited to 0.01% in portable batteries since August 18, 2024. By 2027, the European Commission will submit a report to the Parliament and the Council assessing the possibility of extending these restrictions to other substances deemed harmful to health or hindering safe recycling and the production of high-quality secondary raw materials.

Eco-design as an essential lever

Faced with these demanding regulations, eco-design and life cycle analysis (LCA) are key to reconciling industrial performance and sustainability. Several players shared their experiences:

- Upergy is developing systems to facilitate the dismantling of batteries and enable their reuse (according to Batribox, almost 68% of end-of-life cells are still operational). The company has also launched LCAs on three product categories (alkaline, lead, lithium-ion).

- Addev Materials presented its LEA (Life cycle Evaluation by Addev) tool, which enables simplified assessment of carbon impacts throughout a product's life cycle: production of materials, transport, transformation, end-of-life.

- For its part, In Extenso emphasized the methodological and strategic dimensions of eco-design. The firm pointed out that LCA is a standardized approach (ISO 14040-44) that covers the entire life cycle, from the extraction of raw materials to recycling. The aim is not only to measure impacts, but also to identify the main environmental contributors (critical materials such as cobalt or lithium, the electricity mix of production countries, energy-intensive processes, etc.).

In Extenso's approach is progressive and iterative:

- Start with a simplified LCA to orient analyses and target major levers

- LCA for limited external communication: collect current data, analyze the main contributors, identify eco-design avenues (change of materials, relocation of suppliers, modification of battery architectures).

- LCA for comparative external communication: rework the battery design and assess the impacts of the final scenario.

LCA can play an important role in external communication: companies can use it as a tool for transparency and differentiation, provided they comply with the critical review levels required for wide distribution.

Finally, eco-design is also a response to very real safety and waste management issues. By making batteries easier to dismantle and recycle, the industry limits waste-related accidents (fires in sorting centers, batteries integrated into unidentified equipment, etc.).

Insurance: an industry under pressure

Since 2023, insurance companies have been very reluctant to insure companies in the battery sector, not least because of the potential fire hazard. Premiums have risen dramatically - up to a factor of x5 in the United Kingdom - while coverage has been reduced.

The problem is exacerbated by UCPE regulations, which lower the declaration threshold for lithium battery storage to 6 tonnes. Insurers regard these facilities as particularly risky, even though the consequences of a claim are often far-reaching: property damage, business interruption, data loss, personal injury, product recall & reputational risks, environmental impact.

To regain the confidence of insurers, industry players need to step up their preventive measures: locate and identify batteries, raise awareness, train staff in fire prevention, formalize a coordination and emergency response plan with the fire department, fire surveillance. There seems to be a willingness on the part of the industry to think about setting up its own insurance system, accompanied by safety standards to be respected in order to limit risks.

A future to build between constraints and opportunities

This Battery Working Group has highlighted the extent to which the battery industry is going through a period of profound transformation. The new European regulatory framework imposes strict requirements that redefine producers' responsibilities, while accelerating the transition to a more circular and transparent economy.

At the same time, eco-design and life-cycle analysis are becoming essential levers for innovation, optimizing environmental performance and meeting growing market expectations.

Finally, the question of insurance is a reminder that the competitiveness of the industry depends not only on technological advances, but also on the ability of players to demonstrate risk management and establish a climate of trust with insurers and public authorities.

No comment

Log in to post comment. Log in.